Table of Content

- Reverse Mortgage Manufactured Home Requirements

- Conventional 15-Year Fixed

- How to Avoid Overspending and Keep Saving for a House During the Holidays

- What Are The Red Flags I Need To Look For During The Reverse Mortgage Process

- What is a short sale on a reverse mortgage?

- Frequently Asked Questions About Using a Reverse Mortgage to Purchase a Home

Many of the above-mentioned rules are actually the same as Conventional / forward loans. But youve probably noted, that there are some idiosyncrasies to be aware of. Typically the HECM for Purchase will cover 47%-52% of the new home’s cost.

Borrowers with concerns about their reverse mortgage loan should speak with their reverse mortgage counselor, Irwin said. In addition to discussing the loan repayment process, the counselor can also run a benefits checkup to determine if the borrower is eligible for federal or state resources, such as SNAP or other government programs. The HECM reverse mortgage is a non-recourse loan, which means that the only asset that can be claimed to repay the loan is the home itself. If there's not enough value in the home to settle up the loan balance, the FHA mortgage insurance fund covers the difference.

Reverse Mortgage Manufactured Home Requirements

When you are ready to apply for HECM for a Purchase Loan, you will need to find a lender. Dont forget to explain that you intend to buy a new home with the proceeds from your reverse mortgage. That way, your lender can figure out how much you can borrow based on your financial situation. If you are 62 or over, and are interested in availing yourself of this excellent program, head on over to our advertising partners American Advisors Group. They will send you a free information kit that tells you everything you need to know about reverse mortgages. This substantial down payment combined with the amount of the reverse mortgage pays for the new house outright.

What each lender must do is be certain that they are only doing a reverse mortgage on your "primary residence". I can't tell you how to verify one home is a primary residence over the other, it either is or it isn't. So regardless of your preference, whether you want a fixed rate or an adjustable loan, there is a way to allow you to purchase with a reverse mortgage and accomplish exactly what you are trying to do. I would encourage you to contact us so that we can show you all the scenarios tailored to your parameters. Just remember that you would not be "buying" the home since you do not intend to put a down payment down.

Conventional 15-Year Fixed

A HECM is the only type of reverse mortgage that’s insured by the federal government. To learn more about your heirs options when inheriting a home with a reverse mortgage, see our guide here. The first thing you should do is look at your father's latest statement and see what he owes on the loan.

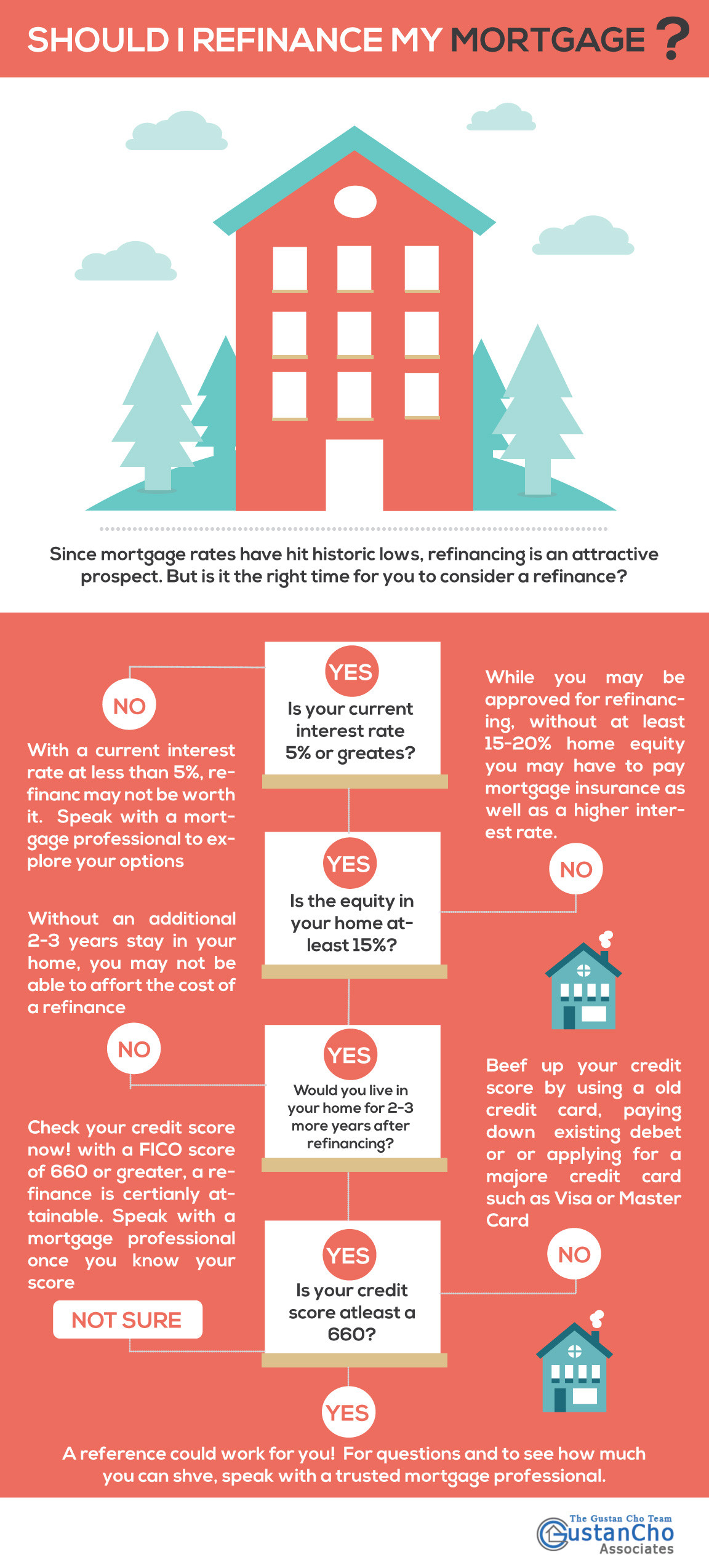

For sources that will work to finance the equity portion of the loan, borrowers can use an earnest money deposit or a withdrawal from a savings account, checking account, or retirement fund. Proceeds from the sale of the previous home and savings are the most common ways for borrowers to meet the down payment requirement. At the first sign of trouble, reach out to your lender to discuss the reverse mortgage problems you are facing. However, refinancing comes with closing costs, so make sure you can afford them. The interest rate on a reverse mortgage may be higher than on a conventional "forward mortgage".

How to Avoid Overspending and Keep Saving for a House During the Holidays

There are also additional reverse mortgages for purchase available from various lenders, each with different specifications. Homeownership involves a number of risks that even the most conscientious homeowner cant completely eliminate. If your home is located in a specific disaster-prone area, adequate insurance coverage is essential.

The Washington’s lived the American Dream, and by making prudent financial decisions they were able to fully pay for both Maise and William’s college education at good state schools. The holidays are a great time to help new homeowners with thoughtful gifts, but the best gifts for new homeowners may not be what you think. That can reassure sellers that you’re a qualified buyer with plenty of money to close on the home. However, if you or they sell the home, you may make little to no money on the sale. With a HECM for Purchase, you get the benefit of having an optional monthly payment but on a new home.

Home Equity Loans

With a HECM for Purchase loan, you’d keep $200,000 in cash, minus costs, which may allow you to delay withdrawals from retirement accounts. There are always costs when selling a home and if the current mortgage balance exceeds the sale price, you would need the lender's approval to sell the home for less than the amount owed. Mortgageloan.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency.

We will never know because we are not privy to the thought process behind their decision. If the value is even close, even though it may still be selling for less than full market value, most investors probably would not be interested no knowing what else may be wrong and without a solid profit margin. As for the balance, all you need to do is get hold of your grandparents' latest statement and it will tell you the balance owed on the loan.

In terms of the use of proceed, applicants are allowed to make one-off withdrawal to pay for property maintenance, medical and legal costs, in addition to the monthly payout. Many retirees take out a reverse mortgage to boost their retirement income, pay for home renovations, give financial help to family members or to help them pay off debt while staying in their current home. In these situations, the reverse mortgage is a kind of refinance mortgage, as opposed to a purchase mortgage. This means that the loan is given based on the equity in the current home, borrowers get to stay in their home and use the funds for a wide variety of purposes.

It therefore does not affect government benefits from Old Age Security or Guaranteed Income Supplement . In addition, if reverse mortgage advances are used to purchase nonregistered investments—such as Guaranteed Investment Certificates and mutual funds—then interest charges for the reverse mortgage may be deductible from investment income earned. Prepayment of the loan—when the borrower pays the loan back before it reaches term—may incur penalties, depending on the loan. An additional fee could also be imposed in the event of a redraw.

No comments:

Post a Comment