Table of Content

A down payment as low as 3% – Your mortgage will cover the cost of up to 97% of your home’s purchase price. If you're looking for a lower-cost mortgage, you may want to check out the Pennsylvania Housing Finance Agency's Keystone Loan Program. You can also find a variety of other PHFA home purchase programs, including 30-year fixed-rate mortgages. Another benefit of an FHA loan is getting approved even with a higher debt-to-income ratio.

This program is open to all home buyers in Pennsylvania who are purchasing or refinancing a single-unit house. However, to qualify for this program, the buyer must contribute at least $1,000 toward the down payment and take a homebuyer education course. The Pennsylvania Keystone Loan Program offers FHA, USDA, and VA loans. It's a government-backed loan program that serves first-time home buyers in targeted Pennsylvania counties.

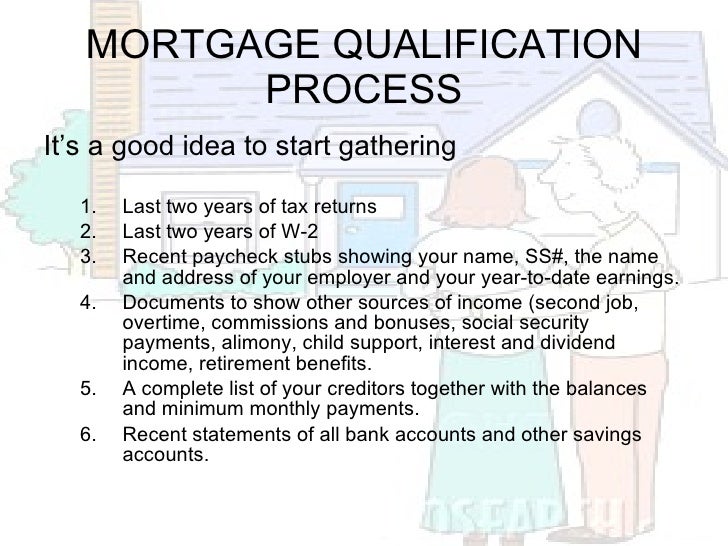

Choose a Loan Type

They also provide information about the program and can work with borrowers who have had a few bumps in the road. And don’t just look at advertised rates online; actually apply for preapproval and compare the interest rates and fees you’re offered. Because that’s the only way to know you’re getting the best deal possible on your new home loan. Home prices in Philadelphia and Pittsburgh remained stagnant in the fourth quarter of 2022. But if you’re hoping to purchase real estate in Allentown, then be prepared for soaring home prices.

It may seem like your dream home is just out of reach when you crunch the numbers. If you find a gap between the upfront cost and the amount you can afford to spend, you might seek financial assistance to make your dream home more easily attainable. In Pennsylvania, there are several opportunities through the state government and other organizations to help new buyers reach their dream of homeownership. A minimum contribution of $1,000 – If you’re eligible for other grants or loans to help cover your down payment, you’ll still need at least $1,000 in your own funds.

Northampton County

Keystone Government Loan is one of PHFA’s first time homebuyer programs in Pennsylvania. It offers government-backed FHA, VA, or USDA Rural Development loans to eligible buyers who have not owned a property in the last three years. First time home buyer PA programs are available to qualified applicants. The homebuyer assistance is provided through a grant, loan, or combination.

These amounts can be up to $20,000 that you’ll have to pay back or up to $7,500 that you won’t have to pay back. The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and there's plenty of good reasons why. Funded by Community Development Block Grant Funds, Upper Darby Township offers a First Time Homebuyer Program to help potential borrowers purchase their first home.

Other Pennsylvania Resources

The value of your HOMEstead program loan will begin dropping by 20% every year as soon as you purchase your home (even though you don’t make any payments). Therefore, your $15,000 remaining on your $20K HOMEstead loan after five years in the house will automatically be forgiven. If you move after the first year, you must pay back 90% of the borrowed sum. This is if it’s less than $10k due to being on time with monthly payments and following other requirements such as not getting another mortgage within five years. Second, even though you might be able to get a higher interest rate than different types of loans, Veterans Affairs loans come with a lower down payment than conventional mortgages do. This means that if you don’t have thousands of dollars saved up for your down payment right now, you can still buy a home.

Here are several opportunities for first-time homebuyers in Pennsylvania to consider. A hot real estate market has its benefits for first time home buyers. There are plenty of properties to look at, and low interest rates make them more affordable in the long run. However, with properties moving so quickly, you need to be ready to make an offer as soon as you find your dream home. K-FITis an assistance grant that offers a second loan with a forgivable rate of 10% over ten years. So, if you move after the first year, you must pay back 90% of the borrowed sum.

There are plenty of programs available to help first-time home buyers in Pennsylvania. They can range from down payment assistance programs to programs that provide mortgage financing. All programs have different eligibility requirements, so it's essential to understand the details before you apply.

In that case, the participating lenders will require that you meet specific requirements to qualify. Allentown does not have that many programs that may be used by future and current homeowners, but they have a first-time home buyer program that may benefit some home buyers. The difference between first-time home buyer programs in Allentown to other cities is that it is not funded by the municipal government but by certain community agencies. First-time homebuyers who earn between 80% AMI and 115% AMI may be eligible to receive up to $5,000 as a 10-year deferred loan with a 0% interest rate. First-time homebuyers who earn less than 80% AMI may be eligible to receive up to $7,500 as a 5-year deferred loan with a 0% interest rate. Complete a home buyer education course through the PHFA or Framework.

FHA.com is a privately owned website, is not a government agency, and does not make loans. This program lets buyers get a single loan with just one closing. You can always talk with a PFHA counselor to learn more about the programs you might qualify for. The cost of your loan interest can be deducted from your yearly income, reducing the total taxable income.

Borrowers with higher credit scores may also qualify for lower rates and/or use their savings or cash reserves to pay down their mortgage principal faster. Among the most important factors that first-time homebuyers consider is whether it makes more financial sense to rent or buy. Bucks County, just like the other counties mentioned above, has its own first-time home buyer program that provides a grant to qualifying individuals. This program is a forgivable grant of 10% of the estimated affordable sales price, and it cannot exceed $10,000. The interest rate on this grant is 0%, and it does not need to be repaid if the buyer meets the conditions for the house.

They provide affordable rates and low competitive interest rates. Pennsylvania has several assistive programs for first-time homebuyers and other homebuyers who want to become a homeowner. This is a home investment partnership program that works throughout PA for people who qualify.

These loans are developed to help low-to-moderate income families purchase their first home and provide down payment assistance if needed. The USDA home mortgage programs offer several advantages to first time homebuyers. This includes low down payment, closing costs, and lower interest rates than many conventional mortgages.

This program offers assistance to low- and moderate-income individuals who wish to purchase a home within the county. Eligibility requirements apply, so visit the website for more information. A PHFA Mortgage Credit Certificate allows qualified first-time homebuyers to claim a tax credit of 20 to 50 percent of the mortgage interest paid per year, up to $2,000 annually.

No comments:

Post a Comment